So, what is ERTC? The Employee Retention Tax Credit was established as part of the CARES Act to...

Wage Payment Requirements

The Fair Labor Standards Act (FLSA), the Davis-Bacon Act, and the Service Contract Act are just a few federal regulations governing wage distributions. State salary payment standards are also imposed by California law. The law more favorable to the individual will be used where federal and state laws differ.

Wage payment regulations are enforced across the state by the Division of Labor Standards Enforcement (DLSE), a department of the California Industrial Relations Department.

TPG wants to help you grasp all the details surrounding the wage payment requirements. Therefore, we have also created a payroll webpage for you to learn more. Check it out now!

Also, be sure to contact one of our TPG payroll experts for further guidance. Call us at 909.466.7876 today!

Payment Method

According to California law, companies must pay employees' wages in legal US currency through check, cash, and direct deposit (which requires optional employee approval), pay card (such as a pre-paid payment card), or any other cost-free method.

Payment Frequency

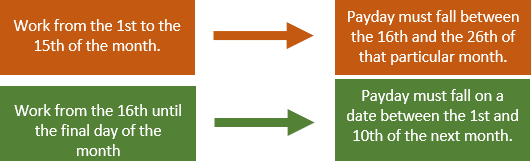

Employees must pay wages at least twice a month on predetermined, recurring paydays.

Employers are allowed to make wage payments earlier or more frequently.

Exceptions

For numerous types of wages, frequency-of-payment restrictions do not apply. For instance, pay for extra hours must be made by the end of the usual pay period, while money for commission, temporary employment, layoffs, and temporary labor may be made at different periods.

Additionally, some workers are exempt, such as:

- Employees paid weekly

- Salaried executive, managerial, and professional workers covered by the FLSA (may receive a payment once a month, before or on the 26th day of the month in which the labor was performed, provided that the full month’s salaries, such as the unearned component between the payment date and the conclusion of the month, are compensated at that moment)

- Licensed vehicle dealer workers (who may be paid once for each month on a date chosen in advance by respective employers)

- Employees in domestic and agricultural labor (will be provided wages once a month based on a pre-decided payday, as long as they receive lodging and board from their workers; paydays are meant to be less than 31 days apart). Individuals who deal with vineyards, crops, livestock, and poultry are referred to as “agricultural employees.” However, this provision does not apply to anyone working for farm labor companies. Wages must be paid by farm labor contractors at least once a week

- Employees protected by a legal collective bargaining contract

Regular PayDay Notification

According to California law, employers are required to prominently post a notice detailing the date, time, and location of payment in a location where employees can view it on a regular basis (if applicable). This notice’s absence will be taken as prima facie proof of a wage payment breach.

Contested Wages

Employers are required to pay any uncontested amount in accordance with the guidelines outlined above if there is a disagreement regarding the amount of wages owed to an employee. When accepting uncontested earnings, an employee does not give up the ability to pursue recovering the disputed amount.

The employer will receive notice if the DLSE decides any wages are due to the employee. Those earnings must be paid by employers within ten days after receiving notice. Additional to any other applicable penalties, employers that are able but deliberately fail to pay these wages within the 10-day window may be liable for triple the amount of any damages.

Last Wage Payment Regulations

The prerequisites for paying an employee’s last earnings are outlined in the table below unless a legitimate collective bargaining agreement is applicable.

|

Any Reason |

• Must be paid by the following regular payday |

|

Layoff |

• Oil drilling industry employment: within 24 hours of termination (excluding holidays and weekends) • Within 72 hours of being laid off: valid for employment in the curing, canning, or drying of perishable fruit, vegetables, or fish |

|

Resignation* |

• If notice of resignation was provided at least 72 hours prior to resignation date, last payment is required to be given at time of resignation • If no official notice was given, last wage payment must be given no later than 72 hours following resignation * excludes contracts with a defined period of duration |

|

Discharge |

• Right upon discharge |

Employers are required to factor in any remaining vacation time and other vested job benefits when determining an employee's final pay. In general, if an individual desires it and gives a postal address, their final salary may be paid via mail. Mailed, postmarked payments must be dated within the stipulated payment window.

Deductions and Withholdings

Employers are not permitted to take anything from an employee's pay (in full or in part) unless the deduction is expressly permitted by law or the employee in writing.

Taxes, union dues, FICA contributions, garnishments, and court-ordered deductions are examples of common legal deductions (such as child support). Finances for employee engagement in hospitalization and plans for savings, medical insurance, and financial institution deposits, donations for charity, stock purchases, plans for retirement, plans for supplemental retirement, wage or loan advances, payments for loans, employer services or goods, employer property or equipment, and wage or loan advances are just a few examples of common deductions approved by employees. These permissions must be granted through a legitimate, binding contract.

Employers are required to accurately record every withholding. In general, unless specifically permitted by law, wage deductions and withholdings cannot bring an employee's gross pay below the required minimum wage. Employers are not permitted to use wage deductions for financial benefit.

Statements for Wages

When salaries are paid, employers are required to give each employee an itemized wage statement. According to the itemized wage statement, the following aspects should be clear:

- Earned gross income

- The amount of time worked for each agreed rate

- The amount of time worked overall (unless the employee is fully employed and excluded from overtime wage payment clauses)

- The percentage of piece-rate components earned and any relevant piece rate if the employee is paid on a piece-rate premise

- The relevant wage rate (or rates) that apply to the employee

- Any withholdings and adjustments for that payment period (must be printed in permanent ink)

- The included dates of the payment period

- The worker's name and the final four digits of their Social Security (or another identity) number

- The employer's address and name

Employers must permit current and former staff to see or copy their personal statements no later than 21 days after receiving a request, and they must retain copies of these documents for at minimum three years. Employers are allowed to take lawful measures to protect a former or current employee's identification. The expense of making copies of an employee's statements is their responsibility.

Penalty

The following list of administrative, civil, and criminal penalties that employers may face if they break California's rules governing wage payment is not exhaustive. Typically, additional to any relevant court fines, acceptable attorneys' fees, and any compliance costs, these penalties are applied.

Penalties for Criminal Activities

Misdemeanor prosecutions for wage payment violations may carry fines, prison sentences, or both. The type of violation will determine the potential penalties.

|

Violation |

Fine |

Imprisonment |

|

General disregard for the rules governing wage payments |

Up to $1,000 |

Up to 6 months |

|

Missing a usual payday notice |

Up to $1,000 |

Up to 6 months |

|

Failure to keep up with a necessary payroll deposit |

Up to $1,000 |

Up to 6 months |

|

Refusal to pay salaries that the employer is capable of paying on purpose |

Up to $1,000 |

Up to 6 months |

|

Intentionally failing to pay a worker's last paycheck* |

Between $1,000 and $10,000 per violation if unpaid salaries are equal to or less than $1,000 |

Up to 6 months if unpaid salaries are less than or equal $1,000 |

|

Between $10,000 and $20,000 per violation if unpaid salaries are higher than $1,000 |

Up to a year if unpaid salaries exceed $1,000 |

|

|

General disregard for the standards of wage statements (with knowledge and intentionally) ** |

Up to $1,000 |

Up to a year |

|

Falsely disputing the amount or legitimacy of an employee's pay with the goal to: • Obtain a discount on the payment of wages owed • Harass, oppress, obstruct, postpone, or swindle the employee |

Up to $1,000 |

Up to 6 months |

|

Illegally withholding or taking from an employee's pay |

Up to $1,000 |

Up to 6 months |

|

Failure to pay the intended destination of any withheld or subtracted payments (with intent to fraud or willful) |

Up to $1,000

|

Up to 6 months for all unpaid salaries less than or equal to $500 |

|

Up to a year for all unpaid salaries greater than $500 |

||

|

Deliberate and knowing violations of the standards for wage statements |

Up to $1,000 |

Up to 6 months |

*If the total of unpaid salaries is less than or equal to $1,000, only one violation penalty will be relevant (imprisonment or fine). A fresh violation is committed each time an employee's final pay are not given. However, the DLSE will take into account the entire sum of all underpaid wages when deciding on the severity of the imprisonment and fine.

** Employers are immune from this fine under state legislation if they can demonstrate that the infraction was an isolated incident and an unintended payroll error caused by a clerical or accidental error.

Civil Fines

Employers who withhold or fail to pay salaries as required shall be penalized in accordance with the following schedule:

|

Violation |

Sanctions |

|

Willful or deliberate disregard for the withholding and deduction rules |

A decision to deliver all outstanding wages, interest, and: • $100 for every original violation or • $200 plus 25 percent of the amount illegally withdrawn for every violation |

|

Not adhering to the standards of the most recent wage payment |

A fine that might reach the amount the employee would have received after 30 days of employment. Employees, however, are unable to impose this fine for the number of days they are inaccessible (they refuse or avoid accepting full payment) |

|

Not adhering to the standards of the wage statement (with knowledge and intentionally) |

A punishment of $250 to $1,000 and up to $4,000 in actual employee losses for each impacted employee. Employers are immune from this fine under state law if they can demonstrate that the infraction was an isolated incident and an unintended payroll error caused by a clerical or unintentional error |

|

Not allowing a current or past employee to view or copy their own pay stubs |

For the first pay period in which the violation occurs, there will be a $750 fine and actual damages (or $50, if higher), plus an additional $100 per employee for each successive pay period's violations (up to a total of $4,000) |

|

Not supplying a wage statement |

• A first-time ticket costs $250 per employee per infraction • Subsequent citations cost $1,000 per employee for each infraction If an employer can prove that a first offense was brought about by a clerical error or an unintentional blunder, they may avoid punishment |

Additional Information

For additional information on California's wage payment and work hour laws, get in touch with TPG Insurance Services. If you'd like to learn more about Subminimum wage rate laws for workers with a disability, click here.