In the dynamic world of compliance regulations, staying on top of key deadlines is essential for...

How to Create an EDD Account for Your Business

One crucial aspect that business owners need to handle is payroll taxes. To simplify this process and ensure compliance with state regulations, you can create an EDD (Employment Development Department). In this article, we will guide you through the step-by-step process of creating an EDD account and enrolling for the Payroll Tax Account Number, also known as the "State EIN" (Employer Identification Number).

Creating an EDD Account

The first step in this journey is to create an EDD account, which serves as the foundation for managing your payroll taxes efficiently. Follow these steps to get started:

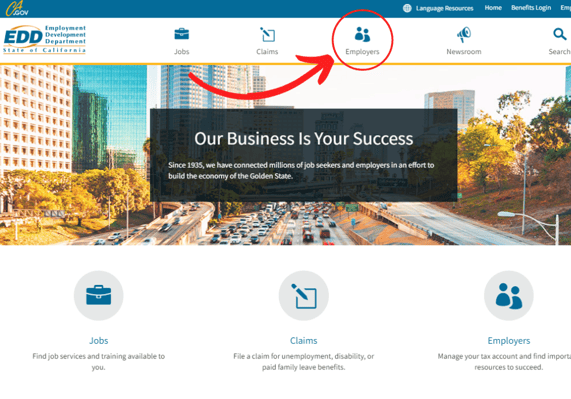

1- Go to the official EDD website: To initiate the process, visit https://edd.ca.gov/.

2- Select "Employers": On the top of the page, click on the "Employers" tab.

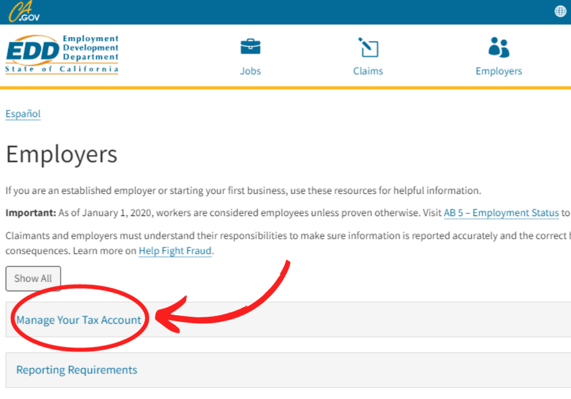

3- Once on the Employers page, find and click on the "Manage Your Tax Account" option.

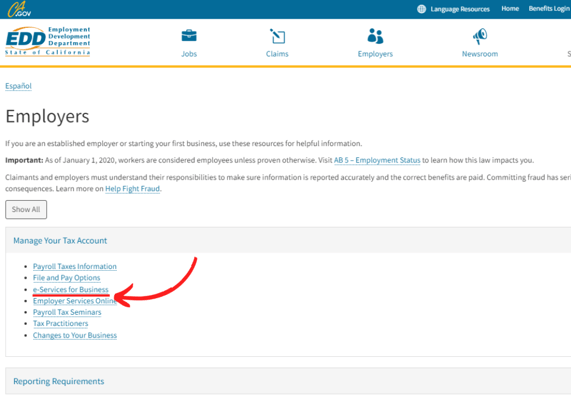

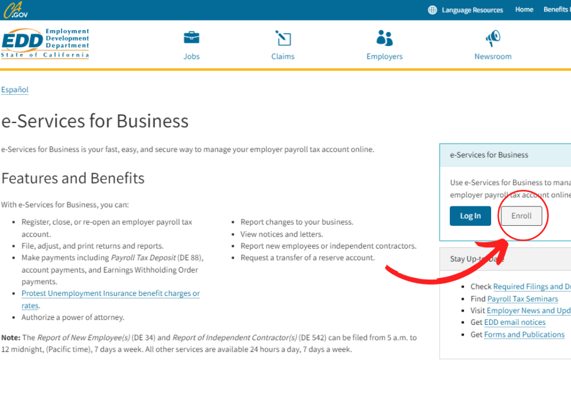

4- From the available options, select "e-services for Business."

5- On the right side of the page, you will find the "Enroll" button. Click on it to proceed.

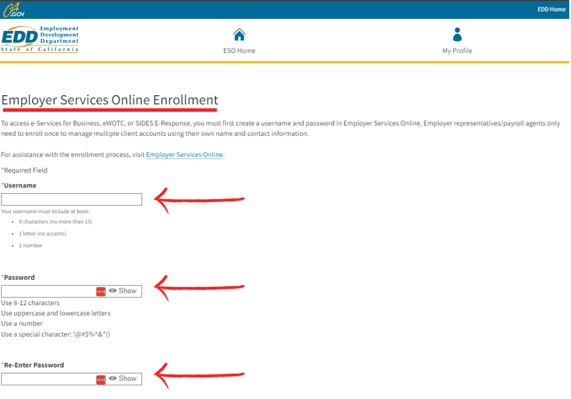

6- Complete Online Enrollment: Create a username and password, as well as the necessary information. Once done, click "Continue" to proceed.

7- Verify Your Email Address: EDD will send a verification link to the email address you provided. Be sure to check your email and click on the verification link to finalize the enrollment process. It's crucial to complete this step within 24 hours; otherwise, you'll need to restart the enrollment process.

Enrolling for the Payroll Tax Account Number

With your EDD account successfully created, the next step is to enroll for the Payroll Tax Account Number, also known as the "State EIN." Here's how to do it:

- Log into e-Services for Business: Visit https://edd.ca.gov/ and log in to your e-Services for Business account using the credentials you created during the EDD account setup.

- Select "New Customer": Within your e-Services for Business account, choose the "New Customer" option.

- Register for Employer Payroll Tax Account Number: Look for the "Register for Employer Payroll Tax Account Number" option and select it.

- Complete the Online Registration Application: Fill out the required information in the online registration application accurately.

- Select "Submit": After completing the application, click on the "Submit" button to initiate the processing of your request.

- Await Processing: It may take 3-10 days for your application to be processed. During this time, EDD will review your application and, upon approval, issue you an 8-digit payroll tax account number, which is also known as the "State EIN."

Conclusion

Navigating the realm of payroll taxes can be complex, but creating an EDD account and enrolling for the Payroll Tax Account Number simplifies the process. By following the step-by-step instructions provided in this article, you'll be well on your way to ensuring your business's compliance with state regulations and efficiently managing your payroll taxes. Take these steps today to streamline your financial responsibilities and keep your company on the path to success.

Do you have more questions or concerns regarding your payroll department? We can help you! Reach out to a TPG Payroll & HR Specialist at 909.466.7876 today!

Also, learn how to Attract Top Payroll Talent With These Benefits, and don't forget to check out our January 2024 Compliance Calendar's Important Dates!